Partnering with +450 German Banks to get the best rates for you

German mortgages can be difficult

But our online-application gives you access to FREE home financing and a whole market comparison individualised to your personal project. We are specialised for:

- First time buyers

- Blue card holders

- Freelancers

- EU Citizens

Your home financing in 4 easy steps

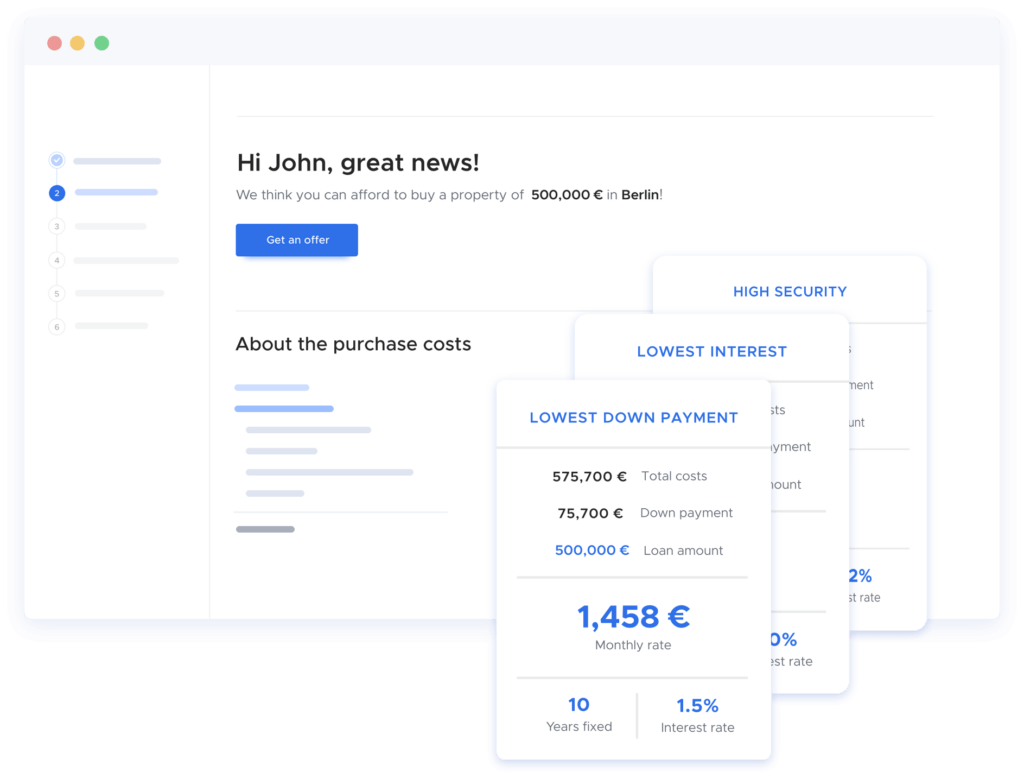

1. Calculate

Find out more about your financing budget

2. See your options

Get your personalised financing offers from +450 German banks

3. Get expert support

Speak to an experienced mortgage advisor

4. Secure your mortgage

Relax and let us secure the mortgage with the bank

Hi I'm Jan,

I will help you with all your German real estate financing needs and find the best offer for you.

As a §34 i GewO certified mortgage broker, I focus on serving first-time buyers and international clients in Berlin and throughout Germany.

I built up and managed the real estate financing team at LoanLink24 and am a partner of Baufi24.

In the last 6 years I have advised more than 15,000 clients. I look forward to working with you to secure your financing.

Why our customers love us

Free mortgage advise

Like most mortgage brokers we get paid by the German lender banks. Unlike many brokers, we will not charge you any fees for our service.

Best mortgage rate guaranteed

We're confident that we will always identify the best rate for you. But if you think you find a lower rate from a different lender, we will try to negotiate a even better deal

What our customers say about us

We help you understand German home loan better

The financing landscape in Germany has undergone significant changes in the past year. At myeasymortgage, we’re dedicated to helping our clients navigate these shifts and find their ideal financial solutions tailored to their unique needs.

As independent mortgage brokers, we specialise in assisting English-speaking clients who reside and work in Germany, as well as international buyers looking to invest in the German property market.

Our team of reliable, English-speaking mortgage brokers is committed to securing the best German mortgage products and lowest interest rates for our international clientele. Beyond just offering impartial guidance in your mortgage decisions, we provide a comprehensive service, assisting you with all inquiries before, during, and after the mortgage process — all at no cost to you.

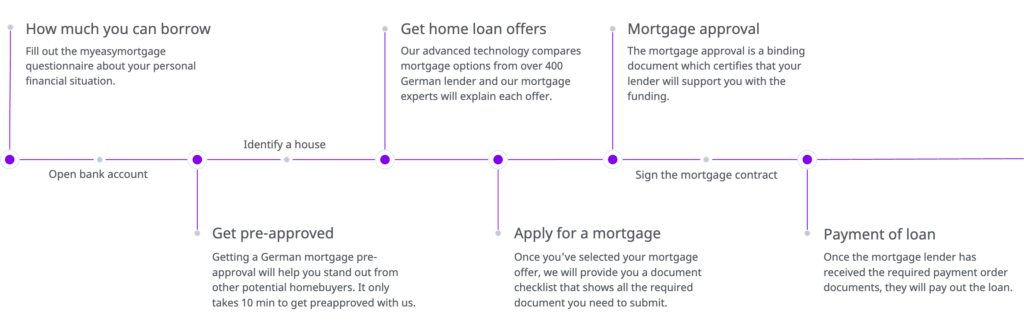

The home loan process in Germany